Some American politicians want to forgive all student loan debt. I disagree with this notion, mostly because I think many private colleges are now charging a ridiculous, inflated price, not supported by evidence of their inherent value to the individual or to society.

I am all in† for learning. I want more kids to earn the benefit of a meaningful education that supports their personal and career goals. I believe that our entire society would benefit if we did a better job teaching our children, from cradle to adulthood.

I agree that our current system is dysfunctional. My opinion is that reforms should aim to correct something more fundamental than the particular loans taken by students who have already left the system. The pricing structure for a university education should be made more rational, not cloaked in additional government intervention.

I don’t want my government paying current‡ “list prices” for private colleges for every student—already a narrow group, disproportionately representing our richest, most privileged children—and especially so when younger, more vulnerable pupils fail to learn in crumbling buildings with more attention paid to test scores than human potential in our mediocre K-12 system.

That being said, I am also on the side of those who argue that our system is inherently unfair and biased against the scores of bright, motivated students often representing the first generation of their families to reach higher education. The financial aid system is byzantine; true costs of attendance are cloaked by “merit aid” and government contributions based on “need” can’t be assessed without filling out reams of paperwork.

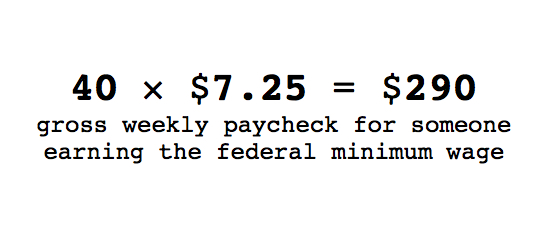

The less experience one’s family has with American higher education as a system, the harder it is to understand any of it at a glance, or even with a great deal of study! Actual costs are opaque. It’s hard to even justify paying a $75 fee to apply to a university whose website says it charges $75,000 per year when your parents earn $7.25* per hour.

That those are real figures which just happen to look like an elegant visual numerical alliteration is the best thing that happened to me today. Sure, fee waivers are available, but how many times does a poor student deserve to be reminded of his deprivation within a single application process? And high school seniors apply to around seven colleges each.

Sure, fee waivers are available, but how many times does a poor student deserve to be reminded of his deprivation within a single application process? And high school seniors apply to around seven colleges each.

Imagine being the 17 year old high school senior, living in poverty, who has to say:

“Hey, Mom, can I have two full weeks’ of your take home pay to buy the privilege of applying for the chance of spending more than five times your annual earnings every year for the next four years to get educated? Yup, that’s right, Mom. The webpage says the price for a college degree is 20 times what you earn per annum.”

Of course financial aid is available to those who qualify; the vast majority (86%) of American students receive some financial assistance towards paying for college. To qualify for aid requires one to complete the Free Application for Federal Student Aid (FAFSA.) That process takes about an hour… if you have ready access to recent financial records and tax returns plus social security numbers for both yourself and your parents.

Aside from the insanity of the FAFSA using a different definition of “dependent child” from the same U.S. government’s Internal Revenue Service (IRS), there is also literally no recourse for a student under age 21 whose parents won’t provide their financial records for the purpose of filling out the form.

Per the Filling Out the FAFSA® Form › Reporting Parent Information page:

“…if your parents don’t support you and refuse to provide their information on the application, you may submit your FAFSA form without their information. However, you won’t be able to get any federal student aid other than an unsubsidized loan—and even that might not happen.”

Until you are age 24—if you’re unlucky enough to have unsupportive parents—unless you can prove via written records that they are in jail, that you had “an abusive family environment” (remember: proof required!), you can’t find your folks at all, or you are over 21 and also “either homeless or self-supporting and at risk of being homeless,” it’s hard to know whether completing the FAFSA will even be worth the effort.

The travail of merely filling out the FAFSA, appears to prevent kids from under-served communities from even approaching applications to higher education.

Oh yeah, and the federal government audits a disproportionate number of financial aid applications submitted by young adults from neighborhoods where the majority of the population is comprised of people of color.

COVID-19 has increased the size of all of these hurdles, apparently. Rates of application to community colleges, for financial aid, etc., have all plummeted in 2020-21 for precisely those students who would benefit most by furthering their educations—those born under a burden of poverty, placed there by circumstance, but forced to carry it on each young back until the lucky ones access the tools required for self-liberation. Education is the most common lever used to pry that burden off.

Go ahead and add that loss to the half a million lives cut short, and tack the cost onto the pandemic’s final bill.

It is an indisputable fact that the United States has systematically de-funded public colleges and universities within the span of my lifetime, rendering even “public” universities difficult to access for all but the wealthiest students. To me, that represents an utter failure of public higher education, a human service that is so important to our nation’s civic character and economic growth that I would consider it part of our basic infrastructure.

It is an indisputable fact that the United States has systematically de-funded public colleges and universities within the span of my lifetime, rendering even “public” universities difficult to access for all but the wealthiest students. To me, that represents an utter failure of public higher education, a human service that is so important to our nation’s civic character and economic growth that I would consider it part of our basic infrastructure.

By definition, I believe public education should be attainable** by 100% of the citizenry.

A recent Boston Globe article detailed a tug of war between the Biden administration which proposes $10,000 per student in loan forgiveness vs. a progressive position championed by Elizabeth Warren and others to forgive $50,000 per student.

Here’s my response: why not tie governmental student loan forgiveness amounts to public college tuition and fees? Whether this is a federal average, rates for institutions in the region where s/he got her education, or the price where s/he lives now, at least this figure would remain tied to some actual, real cost of higher education as it changes over time.

Yet that public tuition rate should also reflect an efficient system, one hopes, seeking to offer a good return on the state’s investment in its future taxpayers. Without the option for limitless borrowing to go elsewhere, the discretionary facilities arms race of ever grander stadiums and shinier, newer dorms to entice potential first years should slow, if not stop altogether.

Typical colleges would have an incentive to keep their published tuition rates aligned to what borrowers could reasonably find the means to pay. Elite universities might maintain higher prices, but their rich endowments would continue to make generous aid packages possible for anyone they chose to admit.

Government regulations tied to hard figures always end up skewed by inflation; income and prices change year by year, typically trending upwards. The Alternative Minimum Tax, for example, was designed to apply to very high income earners who were taking “too many” legitimate deductions, but now it routinely catches upper middle class, dual income families in expensive coastal cities in an indiscriminate dragnet while much richer folks pay money managers to hide and protect larger assets.

Government regulations tied to hard figures always end up skewed by inflation; income and prices change year by year, typically trending upwards. The Alternative Minimum Tax, for example, was designed to apply to very high income earners who were taking “too many” legitimate deductions, but now it routinely catches upper middle class, dual income families in expensive coastal cities in an indiscriminate dragnet while much richer folks pay money managers to hide and protect larger assets.

I’m imagining a scenario where a billionaire politician could pay only $750 in federal taxes while those of us earning far less pay many thousands more…

It strikes me as fundamentally fair and equitable for students electing to attend private colleges to remain entitled to their share of government help, but not necessarily more help than those who opt for public institutions. This would act as a brake on runaway tuition hikes overall while never preventing any private entity from charging whatever it wishes. That seems like common sense, and protective of the public interest.

Another idea that can only be addressed at the federal level would be to offer international skilled worker visas preferentially to companies that implement effective training programs for American workers simultaneously. Those same corporations could sponsor scholarships for domestic students—or create in house programs for local unemployed or underemployed citizens—on a some-to-one or even one-to-one basis for future hires. No reasonable person should expect businesses to hire employees incapable of filling the requirements of a particular role, but our government could ask that those allowed to important talent also take part in reducing that same need going forward.

The U.S. Government should remain involved in higher education. Without an educated populace, the chance that America remains a global superpower rapidly dwindles to near zero. Power—and the money that goes with it—flows to those who control the currency of the day. In 2021, information and technology reign supreme in that arena. The field depends upon a trained workforce to function, though, and there aren’t enough Americans with the requisite skills to fill open positions in U.S. technology firms today. I haven’t seen much evidence to suggest that those odds are improving, either.

The pandemic’s winnowing of the best and brightest poor students in the United States from the ladder of upward mobility via advanced degrees will damage our ability as a nation to compete in the global marketplace, and never mind the real, tragic human cost to those young souls. The ideal role central government can play in education is to ensure equitable access to it for the broadest possible swathe of the populace. Financial Aid is a means to that end, but the American version is a tool that requires sharpening to be used to better effect.

In the meantime, if you are trying to figure out how much college costs right now, be aware that American colleges and universities are required to offer a “net price calculator” somewhere on their websites. Search for it directly from your web browser as some institutions bury this useful tool deep under their admissions information. Also consider Googling the “common data set” for any university you are considering; this standardized form is where U.S. News & World Reports and all those other comparison sites get their college facts. Section H2 will give you a lot of information about how many students receive both need-based and merit aid at the school you are considering.

♦

† I’m fundamentally academic by nature. I left the workforce to devote many of my prime earning years toward the education of my own children. I believe in the transformative power of learning to change peoples’ lives for the better.

‡ Finding an “average price” for college is not straightforward because of the obfuscation about which I’m complaining! Here’s an entire article going into detail about how “net price” differs from official tuition figures, and also separating out the living expenses which paid for by the same source: typically, financial aid. From that US News & World Report article, I got an average price for public colleges of $9,687 compared with $35,087 at private ones. That said, we must recognize that Harvard College’s 2020-21 undergraduate tuition may be $49,653 with fees of $4,315, while its actual, billed “cost of attendance” is $72,357. Tuition itself is almost irrelevant in this discussion, because that latter amount is what “financial aid” would cover.

Harvard hides its tuition information, by the way, not even providing a direct link on its admission page. I had to search for “tuition,” and, not coincidentally, that was the top search term on their FAQ page. Instead of making its price easy to find, Harvard inundates the admission seeking high school student with multiple pages extolling their rich and abundant financial aid offerings. That’s all well and good because such a large proportion of the student body receives aid, but it precisely underscores my point that the system as it stands is wildly complex at the expense of the well being of the student population.

* US Federal minimum wage as of 2020 is $7.25 per hour

** I specifically mean attainable financially here. I do not believe that 100% of the human population should attend traditional colleges and universities, and I think the push in that direction does a disservice to those with inclinations outside of the classroom. If it were up to me, we would have a national network of trade schools administered much like the community colleges, and with identical access to easy, straightforward financial aid for those who need it.

I would argue that it remains imperative for colleges and universities to maintain academic entrance standards. Some students will be excluded because not everyone develops the intellectual capacity for the most abstract forms of thinking, but I’ve never seen credible evidence that this kind of aptitude is distributed inequitably amongst various ethnic, racial, or social groups. Rather, most studies on this issue point to the distractions of poverty and oppression as levers operating against the success of some. I wholeheartedly support reforms that provide every schoolchild with the same opportunity to reach his or her highest potential, but I don’t believe that every one of us was cut out to be a physicist, say, or a fine artist, nor would I hold those individuals up as fundamentally superior to the plumbers and mechanics who keep the systems we rely upon working smoothly.